Maximize returns and minimize taxes with Tax Loss Harvesting. Learn how to optimize your portfolio effectively. Waiting for expert advice.

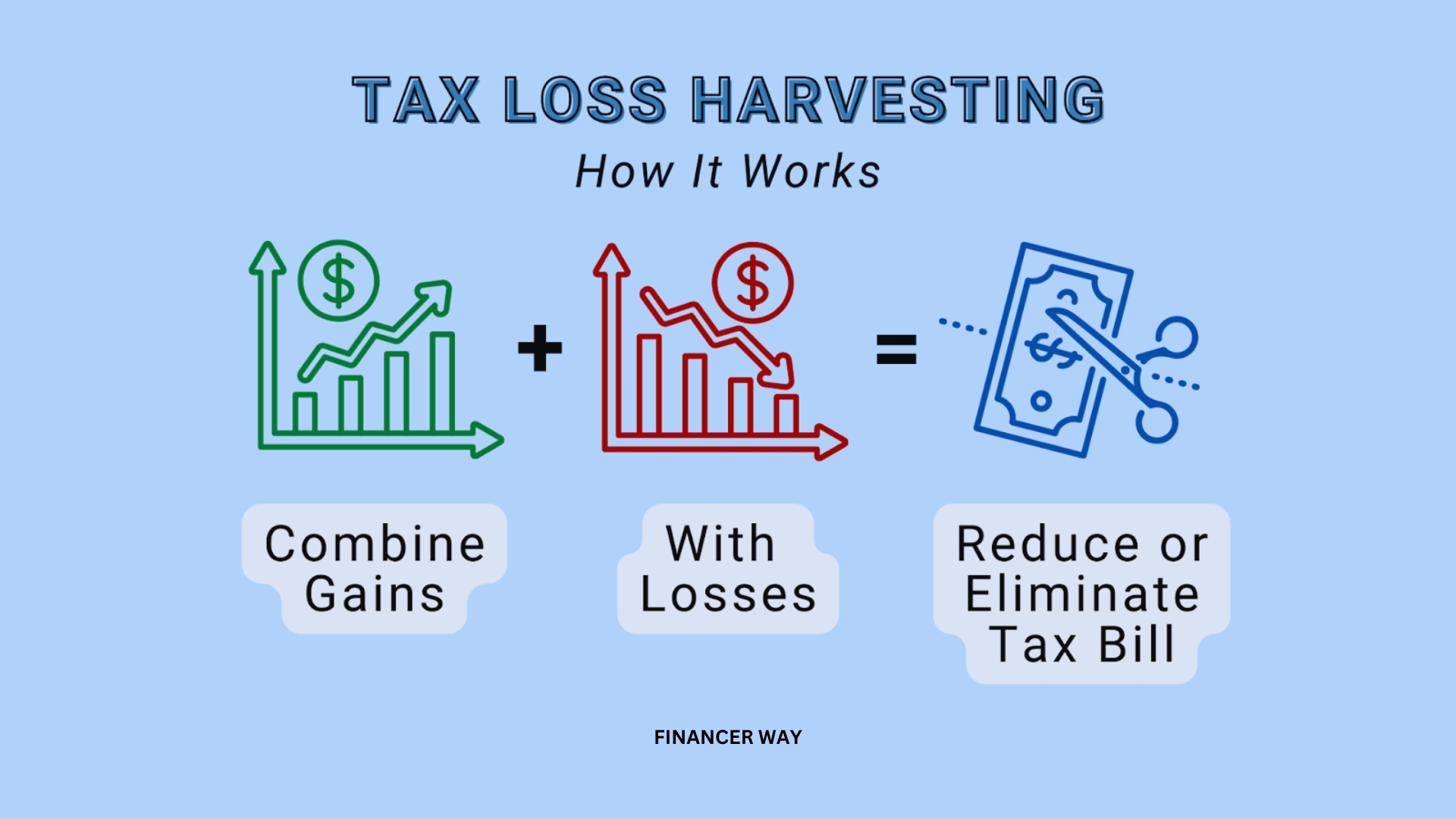

Tax loss harvesting is a sophisticated investment strategy that smart investors use to optimize their portfolios, reduce tax liabilities and ultimately improve returns. It involves strategically selling securities that are experiencing losses to offset capital gains and thereby reduce the investor’s tax bill.

Understand the system

In short, tax loss harvesting takes advantage of the concept of realized losses. When an asset in the portfolio falls in value, the investor sells it to realize the loss. This loss can be used to offset capital gains from other investments, reducing the overall tax burden. Additionally, if total losses exceed profits, the excess loss of up to $3,000 can be used to offset ordinary income, reducing tax liabilities. ( Video by Wise Money Show)

Key benefits of tax loss harvesting

| Securities | Purchase Price | Current Price | Unrealized Gain/Loss |

| Stock A | $50 | $45 | -$5 |

| Stock B | $100 | $110 | $10 |

| Stock C | $75 | $70 | -$5 |

1. Low taxes

By strategically realizing losses and offsetting profits, investors can significantly reduce their tax liabilities. This allows them to retain a higher return on their investment and ultimately increase their net profit over time.

2. Optimize portfolio returns

Tax loss harvesting allows investors to rebalance their portfolio while minimizing taxes. By selling underperforming assets and reinvesting in more promising opportunities, investors can potentially improve the overall return potential of their portfolio.

3. Maintain portfolio diversification

While tax loss harvesting involves selling some securities, that doesn’t mean giving up diversification. Investors can strategically replace sold assets with similar securities to maintain the desired level of diversification in their portfolio.

Implementation of tax loss harvesting strategies

1. Identify profit and loss.

The first step in implementing tax loss harvesting is to identify the securities in which the loss has occurred. Investors should also review their portfolio for real gains that could offset these losses.

2. Strategic Selling

Once profits and losses are identified, investors strategically sell underperforming assets to realize losses. It is important to consider the wash sale rule, which prohibits the repurchase of identical or substantially similar securities within 30 days before or after the sale.

3. Reinvestment

After selling underperforming assets, investors can reinvest the proceeds in alternative securities to maintain portfolio diversification. It is important to carefully evaluate investment options to ensure they are compatible with the investor’s long-term financial goals and risk tolerance.

Best practices for tax loss harvesting

1. Periodic portfolio review

To effectively implement tax losses, investors should periodically review their portfolios. This allows them to identify opportunities for tax optimization and ensure that their investment strategies are in line with their financial objectives.

2. Long-term perspective

While tax loss harvesting can provide short-term tax benefits, investors should also consider the long-term implications of their investment decisions. Overall growth and portfolio stability must be prioritized over short-term tax considerations.

3. Consult financial experts.

Given the complexity and potential tax implications of tax loss harvesting strategies, investors are encouraged to seek guidance from qualified financial professionals. A financial advisor or tax advisor can provide personalized advice based on an investor’s specific financial situation and goals.

Is it worth taking advantage of tax losses?

Tax loss harvesting is a strategy adopted by investors to offset capital gains tax by selling investments that have incurred losses. This practice can potentially reduce taxes owed and improve overall portfolio performance. However, to determine whether it is worth the effort, it is important to understand the principles and limitations associated with tax loss deductions.

Understanding tax loss harvesting

Tax loss harvesting involves the sale of investments that have declined in value to generate capital losses. These losses can then be used to offset capital gains from other investments, reducing the investor’s tax liability. Additionally, any remaining losses can be carried forward to future tax years, providing potential long-term tax benefits.

Tax loss deduction rules

While tax loss harvesting can be a valuable strategy, there are certain rules and guidelines that investors should follow:

Wash Sale Rules

The wash sale rule prevents investors from claiming a tax deduction for a security sold in a wash sale. A wash sale occurs when an investor sells a security at a loss and repurchases the same or substantially similar security within 30 days before or after the sale. To avoid violating the wash sale rule, investors must wait at least 31 days before repurchasing the same security.

$3,000 cap on capital losses

Another important rule to consider is the capital loss limit. In the United States, capital losses are limited to $3,000 per year for individuals or $1,500 for married couples. Any excess losses above this limit can be carried forward indefinitely to future years.

Why are capital losses limited to $3,000?

A $3,000 cap on capital losses is set by the Internal Revenue Service (IRS) to prevent taxpayers from using excessive losses to offset other income. By limiting the amount of capital losses that can be claimed in a tax year, the IRS aims to maintain the integrity of the tax system and prevent the abuse of tax loss harvesting strategies.

Can inventory losses be claimed on taxes in Canada?

In Canada, investors can also claim capital losses on their taxes, although the rules may differ slightly from the US. Generally, Canadian taxpayers can use capital losses to offset capital gains earned in the same tax year or carry forwards to offset gains in future years. However, it is important to consult a tax professional or financial advisor to understand the specific laws and limitations regarding stock loss claims in Canada.

Conclusion

Tax loss harvesting is a powerful tool that allows investors to optimize their portfolios, reduce tax liabilities and ultimately improve returns. By strategically recognizing losses, offsetting gains, and maintaining portfolio diversification, investors can maximize the performance of their investment strategies. However, it is important to approach tax loss harvesting with careful consideration and consultation with a financial professional to ensure it is consistent with long-term financial goals.