Find the best Quicken subscription alternatives. Explore feature-rich options to manage finances without recurring fees.

In today’s digital age, managing personal finances has become much easier with the advent of software like Quicken. However, the subscription model adopted by Quicken may not be right for everyone. For those looking for a subscription-free alternative to Quicken, there are several solid alternatives available that offer similar functionality without recurring costs. Let’s take a look at some of these options and learn about their features in detail.

| Software | Key Features |

| GNUCash | Open-source, expense tracking, budgeting |

| Personal Capital | Investment tracking, budgeting, free version |

| Moneydance | Multi-currency support, budgeting, one-time purchase |

| YNAB | Zero-based budgeting, annual membership fee |

| Tiller Money | Integration with spreadsheets, customization |

1. GnuCash software

GNUCash has emerged as a powerful open-source alternative to Quicken. It offers comprehensive features for personal and small business financial management, including expense tracking, invoicing, and budgeting. One of the main advantages of GNUCash is its flexibility, which allows users to customize the software according to their specific needs. Plus, because it’s open source, users can access a vibrant community for support and updates, without the burden of subscription fees.

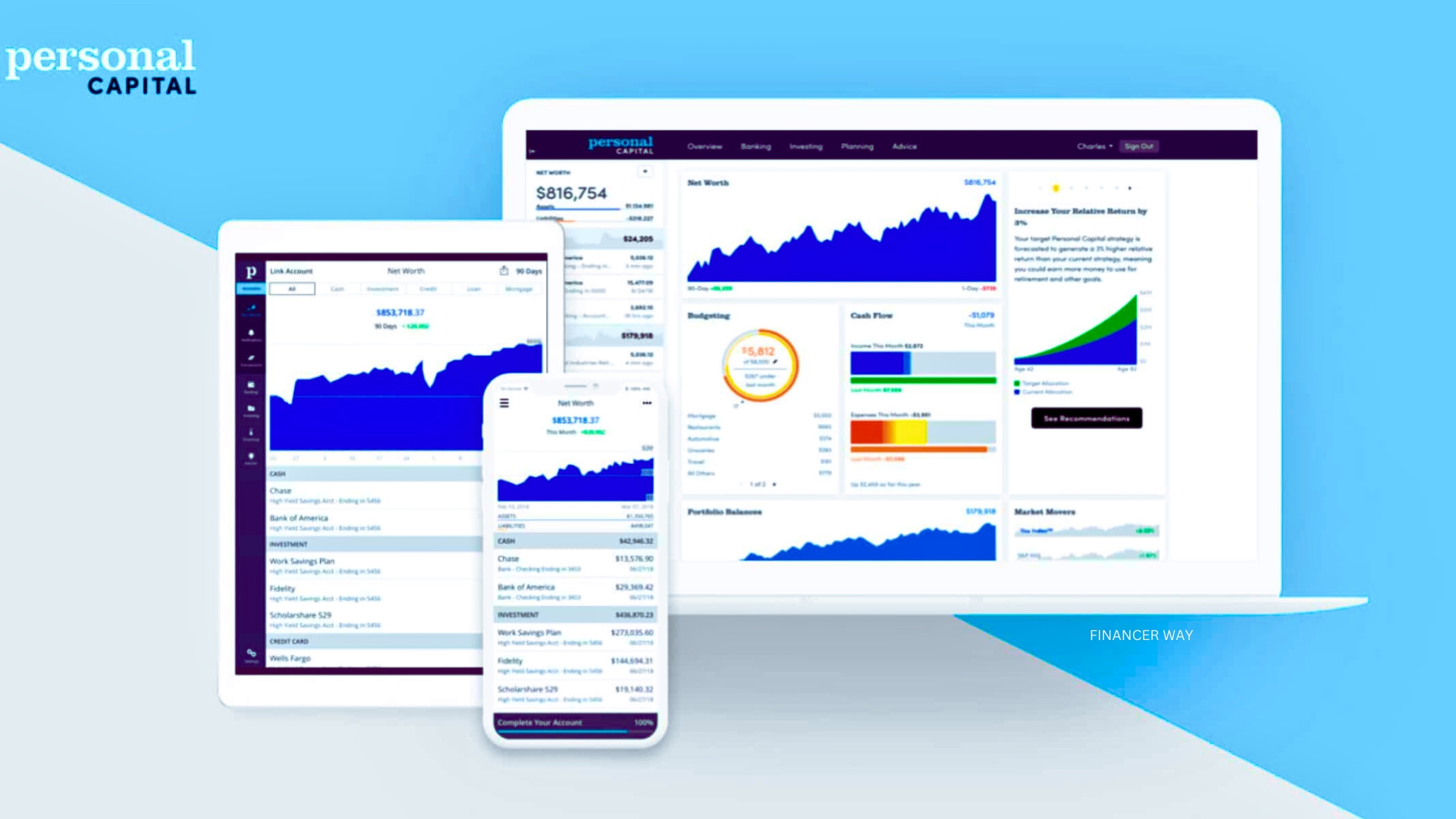

2. Personal Capital software

Personal Capital is another popular option for those looking for Quicken-like features without a subscription. It combines budgeting tools with investment tracking, giving users a holistic view of their financial health. With Personal Capital, users can link their bank accounts, investment accounts, and credit cards to get real-time insight into their spending patterns and investment performance. While Personal Capital offers a free version, premium features are available for those wanting more advanced functionality.

3. Money dances software

MoneyDance is a versatile Quicken alternative that offers robust features for budgeting, investment tracking, and invoice management. With its intuitive interface and cross-platform compatibility, MoneyDance provides users with a seamless experience across all devices. One of the standout features of MoneyDance is its ability to handle multiple currencies, making it an ideal choice for international users. Additionally, MoneyDance offers a one-time purchase option, eliminating the need to pay recurring subscription fees.

4. YNAB (needs a citation) software

YNAB, short for You Need a Budget, is a budgeting software focused on helping users take control of their finances and prioritize their spending. Unlike Quicken’s subscription model, YNAB operates on a subscription-based pricing structure, where users pay an annual fee to access the platform. YNAB’s strength lies in its zero-based budgeting approach, which encourages users to allocate every dollar to one thing, thereby promoting conscious spending habits.

5. Farmer’s money software

Tiller Money integrates with Google Sheets and Microsoft Excel to provide a unique approach to personal financial management. This Quicken alternative automatically updates users’ financial data in spreadsheet format, giving them full control and customization over their financial tracking. With Tiller Money, users can create custom budget templates, track expenses, and visualize their financial progress, all without the hassle of a subscription model.

Conclusion

Finally, while Quicken is a popular choice for personal financial management, there are several alternatives available for users who prefer to avoid subscription fees. Whether you’re looking for an open-source solution like GNUCash, a comprehensive platform like Personal Capital, or a one-time offering like Tiller Money, subscription-free software options like Quicken are diverse and feature-rich. By exploring these options, consumers can find the solution that best suits their financial needs and preferences.

Frequently Asked Questions

Q. Are there any free software available for these options?

A. Yes, Personal Capital offers a free version with basic features. However, other options like GNUCash and Moneydance may require a one-time purchase or offer limited functionality for free.

Q. Can I access my financial data across multiple devices?

A. Most options, like Personal Capital, MoneyDance, and Tiller Money, offer cross-platform compatibility, allowing users to access their financial data on multiple devices, including desktops, laptops, and mobile devices.

Q. Are these options suitable for small business use?

A. Although these options are primarily for personal financial management, some, like GNUCash, offer features suitable for small business use. However, customers should evaluate their specific business needs before choosing a solution.

Q. Do these options support automatic transaction synchronization?

A. Yes, many options, including Personal Capital, MoneyDance, and TillerMoney, support automatic syncing of transactions with bank and credit card accounts, streamlining the process of tracking spending and managing finances.

Q. Can I import my Quicken data into these options?

A. In most cases, yes. Many options offer import functionality that allows users to seamlessly transfer their financial data from Quicken. However, users should refer to the specific instructions provided by each software for guidance on importing data.

Additional Information

Community support: Most options have active user communities where users can get help, share advice, and participate in discussions about personal financial management.

Mobile Apps: Many options offer complementary mobile apps, allowing users to manage their finances on the go and stay connected to their financial data anytime, anywhere.

Security: These options prioritize data security and use strong encryption methods to protect users’ financial information from unauthorized access.

Updates and Support: Users can expect regular updates and ongoing support from the developers of these options, ensuring a smooth and reliable user experience.

Trial period: Some options may offer a trial period or money-back guarantee, allowing users to try the software risk-free before making a purchase or subscription.