Bitcoin surged to a one-month high on Monday, extending its rally after last week’s significant Federal Reserve rate cut. FXTM Senior Market Analyst Lukman Otunuga highlighted that looser financial conditions could signal a favorable outlook for bitcoin bulls, driving increased demand for digital assets.

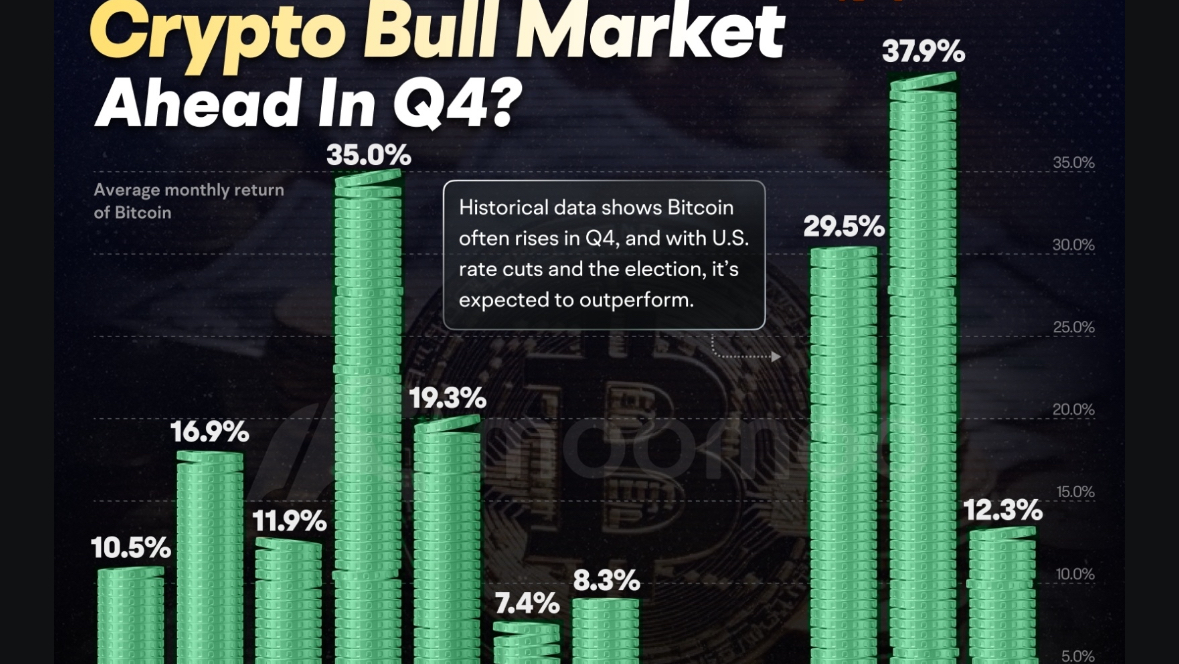

Historically, Bitcoin has shown a cyclical performance, with certain months consistently delivering weaker or stronger returns. From 2013 to 2024, data reveals that September tends to be one of Bitcoin’s weakest months, with average returns of -4.89%.

However, this is typically followed by a strong recovery in Q4, where Bitcoin has historically posted average returns of +88.84%. This suggests that despite the September slump, Bitcoin often experiences robust quarter-on-quarter growth by the end of the year.

What’s behind the rally?

Fed Rate Cut Fuels Surge in Crypto Inflows

Bitcoin’s price has fluctuated significantly over the past month as the market anticipates the Federal Reserve’s first post-pandemic interest rate cut, with traders largely betting on a 25 or 50 basis point reduction. In an open letter, U.S. senators urged Fed chair Jerome Powell to cut rates, warning that delays risk pushing the economy into a recession.

A 50 basis point rate cut and record-breaking gold prices have strengthened Bitcoin’s position as an alternative asset. Bernstein noted that “any signals of loose monetary policy, along with a potential weakening of the U.S. dollar, are positive for Bitcoin.”

Bitcoin Bulls Expect Price Rise Regardless of Election Outcome

At the Future Proof festival in California, Tom Lee of Fundstrat and Michael Novogratz of Galaxy Digital discussed the upcoming election as a win-win scenario for Bitcoin. Former President Donald Trump, a vocal supporter of crypto, has pledged to fire SEC Chair Gary Gensler, who is seen as an adversary to the industry. While Trump hasn’t committed to purchasing Bitcoin for the government, his pro-crypto stance has garnered significant attention.

Vice President Kamala Harris has yet to take an official position on crypto, but some believe she could pivot in favor of it if elected. Lee noted that Bitcoin’s recent gains may be linked to Trump’s rising odds, while Novogratz suggested that being anti-crypto is not smart politics, adding that Democrats are catching on, though Trump has led the charge.

Bitcoin ETFs Inflow Rebound After Sell-Off

In the short term, US-traded spot Bitcoin ETFs experienced nearly $1 billion in outflows between August 26 and September 6 during a Bitcoin sell-off, but most of these losses were recovered over the following two weeks, with $801 million in inflows from September 9 to September 20, according to Farside Investors. Notably, the largest inflows occurred on September 17, one day before the Federal Reserve’s FOMC meeting, with $186.8 million directed into Bitcoin ETFs, likely influenced by the Fed’s rate cut. In the long term, Bernstein predicts that as more brokers approve these products, ETF inflows will “reaccelerate.”

Crypto-Related Company Fuels the Demand

On September 20, MicroStrategy CEO Michael Saylor announced the purchase of an additional 7,420 bitcoins for approximately $489 million, bringing the company’s total holdings to over 252,000 bitcoins, acquired for $9.9 billion. Since 2020, MicroStrategy has focused on a Bitcoin-centered strategy, viewing the cryptocurrency as a hedge against inflation and a store of value. To fund these purchases, the company has raised over $1 billion through convertible senior note offerings.

What’s Next For Bitcoin?

Correlation studies show that digital assets and U.S. stocks are moving more in sync than ever before, indicating that the macroeconomic variables driving stock market trends are also influencing the cryptocurrency market. Although market reactions were volatile following the Fed rate cut, Bitcoin is likely to benefit from lower interest rates and a weaker dollar over time.

Source: CryptoSlate, Yahoo Finance